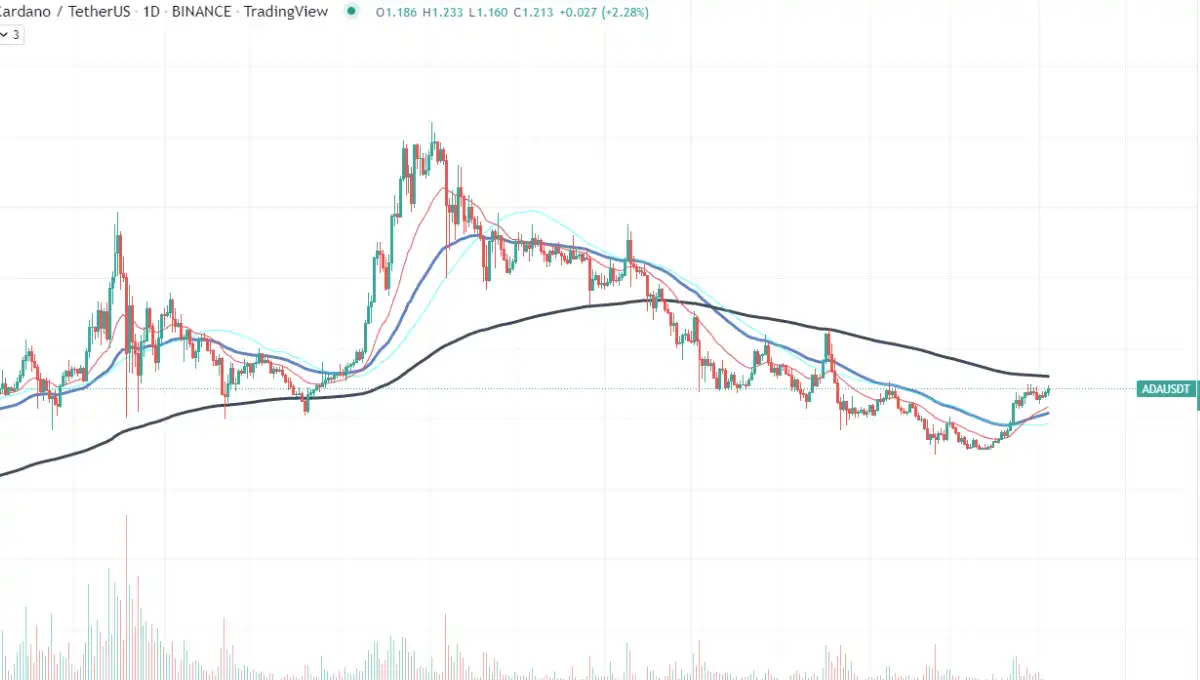

Cardano’s native token, ADA, has broken past the asymmetrical triangle, a powerful technical pattern. As per TradingView, ADA entered the triangle around the end of March and is still integrating within it for the past 14-days.

Based on the chart, the uptrend occurred at the start of another day for trade, with Cardano surging to $1.2 in short hours. After three failed attempts to achieve $1.25, the latest milestone corresponds to the resistance level that emerged.0

ADA/USD Chart. Source: TradingView

A price increase was not possible after the breakout, and the coin dropped from $1.23 to $1.21 immediately afterward. Weekend trading is usually less busy than trading on weekdays. It could be why there wasn’t a lot of purchasing power at the start of trading.

The Fundamental Evolution of Cardano

Earlier, U.Today explored seven novel utility cases deployed on the Cardano ecosystem and are projected to drive millions of dollars into blockchain-based platforms, likely to boost the token’s price as demand increases.

It was earlier reported that the Cardano ecosystem had experienced rapid expansion because of services including DeFiLIama, which found that the Decentralized Finance network had attracted Cardano worth over $200M in new users within a month of projects.

Last month, the Cardano rise was powered by the strong increase in TVL and the total users, with the token up over 55 percent since 16th March. With 2 percent gain in just the previous few hours, the price of Cardano had hit its ATH since 8th February, when it was trading at $1.21 per coin.

Price Movement and Developments

The ADA stock price rose to $1.23 from its low of about $1.10 on 1st April. Cardano is currently trading at a 60.95 percent discount to its ATH of about $3. When Cardano loses money, ADA is still trying to get back some money. Whales continue to purchase ADA.

There has been a 50-fold increase in on-chain activities volume for ADA, which has led to a significant influx of institutional money into the system. The quick rise in institutional volume shows the project’s rising intrinsic importance. Since January, there have been several developments on the blockchain, including EMV-compliant L2.

Because of this, Ethereum-based decentralized applications can now run on Cardano, thanks to the new ease with which assets can be moved amidst both chains. It is accomplished using wrapped smart contract technologies, which Milkomeda started.

Cardano is starting to become very crucial to institutional investors, hoping for real value instead of speculative gains as alternative technologies are launched on-chain. Based on CoinMarketCap data, Cardano has successfully outperformed the top ten cryptocurrencies with regards to 24-hour gains, which rose by percent to about $1.21.