The popularity of forex trading is on the rise. A number of online brokerages have been established, which are not offering online trading platforms for retail traders where they cannot just trade foreign currencies, but a number of other assets as well. More and more people who used to do 9 to 5 jobs are now switching to trading because of its potential to help them in earning better and enjoying a great deal of freedom. The forex market, in particular, has attracted the most attention because it is the most liquid financial market in the world. Therefore, it offers a huge potential of making profits and commissions, trading costs and leverage is all low.

Other than that, forex trading is also quite straightforward. These days, a large number of brokers have chosen not to charge commissions and they are making money through the ‘spread’. However, it is also important to know that brokerages that charge lower spreads than others may also have some form of commission in place. Hence, it is essential for you to be aware of all the costs involved before you take any major trading decisions.

Nearly all financial markets, including the forex currency market, operate on the basic principle of supply and demand. For instance, if there is a high demand for the dollar, the value of the currency against others will increase. This is precisely the basis used for working out forex spreads. Put simply, the spread refers to the difference between the price that’s paid by the forex broker to purchase the currency from you and the price at which they sell it. For instance, the spread for a position where the US dollar is the base currency will always be less as opposed to the spread available for a less common or popular currency, mostly due to the high demand of the dollar.

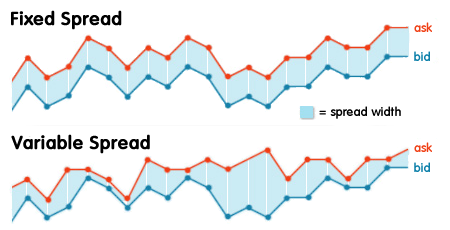

It is easy for the broker to sell the dollars they purchase. Consequently, they do not need to charge you for it by giving a higher spread. It is due to this reason that traders are advised not to buy or sell forex currency pairs that have a low demand. The higher spread for these currencies will only increase your trading cost in the long run. Two different types of spreads are offered by brokers in the forex market. These are floating or variable and fixed spreads. The former will vary according to market behavior whereas the fixed will remain constant even during news releases.

As compared to floating spreads, fixed spreads tend to be wider. In most cases, they will range between 2 to 3 pips. On the other hand, floating spreads will widen considerably at the time of news releases or major events. This means that fixed spreads can be extremely handy in protecting you from spread swings because they provide a great deal of predictability. These spreads can come in handy during the time of trading news releases or scalping. While it is true that you may be able to make slightly higher profits due to spread swings, but they can also lead to a great deal of losses at times if you are caught unprepared.

There are several more advantages that fixed spreads can offer to forex traders. They make it easier for them to apply automated trading strategies and trading bots and have smaller capital requirements. Traders can enjoy a great deal of transparency and they enable better and effective trade planning. This is because you are always sure of what you will have to pay when you execute a trade. Fixed spreads are also beneficial for scalpers because they take small profits in several trades in a day and these serve them better.

One important thing to note is that only market makers can guarantee you fixed spreads. Therefore, it is best for you to look for fixed spread brokers when you decide to start trading in the forex market. Here are the top 3 fixed spread brokers you can use:

- Plus500

Plus500CY Ltd. established the Plus500 forex trading platform. The company is based in Cyprus and its headquarters are located in Limassol. The Cyprus Securities and Exchange Commission (CySEC) authorizes and regulates the broker. It is also regulated in other countries, such as by the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA). The broker type is market maker, which means that it can provide you the fixed spreads you are after. Plus500 offers you two trading platform, which are WebTrader and Windows Trader, respectively.

The minimum deposit requirement of the broker is $100, which is great because even beginner traders can sign up easily. It offers multiple deposit options to the traders, including credit card, Skrill, PayPal, bank wire transfers and more. The maximum leverage that Plus500 can offer is 50:1 and the minimum lot size is 0.01. The lowest spreads are offered for EUR/USD and they are 2 pips.

- FBS

An international forex broker, FBS has spread its operations in over 120 countries. This online forex company is currently being used by 2,000,000 traders and it also has around 130,000 partners. Islamic or swap-free accounts are provided by the broker for Muslim traders. The broker was launched in 2009, but it doesn’t offer its services to traders in the USA, Japan and Belize. The broker type is DMA/STP, ECN/STP and MM. The best part about the broker is that it has a minimum deposit requirement of $5, which is essentially nothing as compared to other brokers in the market.

You can make your deposits in your account with the broker through various methods, including Perfectmoney, Webmoney, wire transfer, Visa and MasterCard, Yuu Pay, Skrill, Neteller, FBS Exchanger, OKPAY and more. If you are searching for fixed spreads, you can sign up with this broker because they offer you both fixed and variable spreads. Thus, if you want to switch later on, you can do that as well. The maximum leverage that FBS offers to you is 500:1 whereas the minimum lot size that the broker offers is 0.01. As far as the lowest spreads offered by the broker are concerned, they are also available for EUR/USD currency pair. The Mini accounts offer 2 pips while they are between the range of 1 and 2 for Standard accounts.

FBS also has a multitude of account options to offer to its clientele, which has worked in the broker’s favor and has allowed it to gain more and more users. The additional account options enable traders of different skill levels and background to sign up with the broker and benefit from its fixed spreads and other similar services.

- InstaForex

Launched in 2007, InstaForex has become a brand since then because it has more than 3,000,000 customers. It is also impressive to know that almost 1,000 people sign up every day to open an account. This is due to the fact that the broker has plenty of avenues to offer to the traders, which include contracts on derivatives, ECN forex trading and numerous other instruments. The broker type is ECN and the good news is that it is also regulated by RAFMM/CRFIN.

With InstaForex, traders can take advantage of a variety of trading platforms, which can make it extremely easy for them to trade. The trading platforms include MT4, MT5 as well as WebTrader, which means everyone can find something that suits their needs. By offering these options, the broker keeps up with market trends and ensures that its customers can access all the latest tools and features for making successful trades.

The minimum deposit requirement imposed by the broker is $1, which is not a requirement at all. This means that you will be able to trade, no matter how little you have to invest. The deposit options offered by InstaForex are also a plus because of their variety. You will find everything from traditional wire transfer to credit cards and even advanced and modern options including RBK money, PerfectMoney, Moneybookers, Bitcoin, Yandex.Money, Webmoney, QIWI and more. You will find both fixed and variable spreads available at InstaForex, which is a plus because it gives you the freedom to switch, if you ever want to.

Otherwise, you can simply use fixed spreads to keep your losses to a minimum as you will know what you stand to lose. The maximum leverage that the broker has to offer is around 1,000 whereas the minimum lot size is about 0.01. The lowest spreads that you will find are for the EUR/USD and is around 3 pips.

These are the top three brokers that offer you fixed spreads and as mentioned above, their capital requirements are also low. These brokers are extremely trustworthy and reliable due to which they have gained a large number of users over the years. The sign up process associated with these brokers is very straightforward and they also offer you a horde of currencies you can trade, which empowers you to get started right away and reap the rewards of this market.